The Panic of 1907 is the reason why we have the Federal Reserve System today.

The 1907 Bankers' Panic or Knickerbocker Crisis was a United States financial crisis that took place over a three-week period starting in mid-October,

when the New York Stock Exchange fell almost 50% from its peak the previous year.

The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company.

When this bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts,

leading a week later to the downfall of the Knickerbocker Trust Company — New York City's third-largest trust.

Panic extended across the nation as vast numbers of people withdrew deposits from their regional banks.

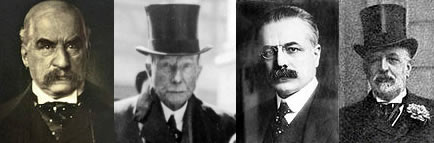

J.P.Morgan, John D. Rockfeller, George Cortelyou and Lord Rothschild

The panic might have deepened if not for the intervention of financier J. P. Morgan, who pledged large sums of his own money to shore up the banking system

and convinced other New York bankers to do the same. By November, the financial contagion had largely ended, only to be replaced by a further crisis when a large brokerage firm borrowed heavily

against the stock of Tennessee Coal, Iron and Railroad Company (TC&I) whose price subsequently plunged.

The following year, Senator Nelson W. Aldrich, father-in-law of John D. Rockfeller, established and chaired a commission to investigate the crisis and propose future solutions,

leading to the creation of the Federal Reserve System.