You have selected to receive Market Essentials from VIXCONTANGO. To discontinue emails, change your alert settings or reply to this email requesting removal.

Stablecoin vs Central Bank Digital Currency Debate

The big discussion this summer in Fed and Wall Street circles is outlining a digital strategy for the US dollar. The topic of the Jackson Hole conference this year is central bank digital currencies (CBDC) as Jay Powell has already announced. The US is hardly the only country looking to create a central bank digital currency. Country after country (most notably China) is making announcements on that topic. Over in crypto world, degens are trying to create an all-together different kinds of stablecoin. I will look at both what is happening at central banks and the crypto industry and give you a framework for how to understand the debate and the topics involved. The algorithmic stablecoins by the degens will be discussed in subsequent mailer.

History of Public Sector Money vs Private Sector Money

Before I dive in, I want to preface with a quick run down through the evolution of money technology through history. I think this is needed to understand correctly the CBDC vs stablecoin debate. The origins of money in pre-historic man is trade Ė trade a horse for a cow for example. We have exchange of value for value. Obviously, once distances got bigger trade required travel and the roads became full of danger. Various power structures (armies, bandits, warlords) would demand a tariff (or a tax) if a merchant wanted to pass through their territory with his valuable goods safely. Obviously, taking everything would cause trade to halt completely and 100% of zero is zero so the warlords had to keep the tariff to a reasonable level where merchants would still have an incentive to pass and enrich both themselves and the warlord. Feeding an army isnít cheap. However, a warlord can only get so many in-kind payments such sheep and cows. Warlords are mobile so they have to be able to carry their wealth around with them. Or actually better yet Ė hide it somewhere. Obviously cows are hard to hide. Overtime, warlords started demanding to be paid in precious metals like Gold and Silver because these metals are easy to carry and more importantly - easy to protect and hide. They donít rust, can be subdivided and also molded into jewelry and other status symbols that can be worn (self custodied). Overtime warlords became kings and created governments. The tariffs became taxes. Their accumulated gold started to reside in the Kingís treasury where it was protected by an army. That treasury was then used to buy armies who would then conquer enemies and then take their gold. To incentivize the population to work, the kings issued coins from the kingís treasury and then demanded them back as tax payment. For a couple of millennia Gold was money in the form of government issued coins Ė both a store of value, unit of account and medium of exchange. However, once all enemies are conquered, you have to dig Gold out of ground and that got more and more difficult and expensive over time (in terms of human effort). As population grew, there wasnít enough Gold to go around. So Kings started to devalue their gold coins. They put less Gold in them and more of other less valuable and less scarce metals like Bronze and Silver.

Fast forward to the invention of the printing press and the Medici in the 1500s figured out that you can use paper as medium of exchange instead of a gold or silver coins which were heavy to carry around. So the Mediciís put all their clients gold in a building with an army around it and gave out paper certificates of ownership. Voila Ė the worldís first private sector bank. Mediciís were the first merchants to become bankers and then heads of state since before that was primarily the province of military aristocracy. There were able to survive all the attacks by the military folks because the economy during their reign was good. How were they able to expand the economy? Through fractional banking. They figured out that people just keep the Gold in their bank forever and never actually use it as medium of exchange to make payments. People would use the paper certificates to make payments (bad money crowds out good money principle). They were clever enough to decide to issue more paper than the Gold they had on hand giving birth to fractional banking. And because they literally conjured up money out of thin air they were able to expand the economy beyond the supply of Gold reserves that they had. Their aristocratic opponents were completely befuddled Ė the Pazzis never could calculate where the heck this money is coming from. Obviously, that was a good trick until others figured out and when they did that is when bank runs started. If people figured out that the bank doesnít have enough gold for all the redemptions, they would rush to be the first to drain the gold reserves of the bank.

Medici style private bank credit decisions in relation to their gold reserves was what created money in the economy (instead of just gold and silver mines like before the Medicis) for a few more centuries until we arrive at Abraham Lincoln and Treasury Secretary Salmon Chase and the Civil War. To finance the Civil War, Lincoln needed the banks to lend him money to build an army and they did that on the promise that they will get income from taxation of the conquered Southern territories. The banks bought war bonds (ie gave money to Lincoln to build army) and in return got paper certificates (Treasuries) that gave them a right to collect interest payments from the US treasury. This created a dual system of money in the United States where you had public money issued by the US treasury and private money issued by banks. They were both called US dollars but where different. Once was a private bank note representing a client deposit, the other was a US treasury note. One is a liability of the bank (ie the bank owes the deposit to its client), the other is an asset of the US government (they can collect it via tax and also backed by the US governmentís gold). One I call Medici money (private sector bank deposits), the other I call Lincoln money (public reserves financed from taxation). One is private sector money (Medici), the other public sector money (Lincoln). In the Guilded Era, we have quite a few bank runs on these private banks but no runs on the US treasury and fast forward to 1914 and we have the Fed created to stop these constant bank runs by merging the Medici (private sector) and Lincoln (public sector) money into one Central Bank which will guarantee all money in the United States including private sector bank money up to a point (it is called federal deposit insurance today and bank deposits are insured up to $250,000).

Fast forward to 1974 where Nixon completely decouples the US dollar from Gold after a few international bank runs from Europe to drain the US treasury from its Gold. US dollar now has no linkage to Gold (ie it is not redeemable for Gold) which was considered base money for a couple of millennia and was what fractional banking was based on originally. That doesnít mean that Gold doesnít have value or that it isnít a monetary asset. Quite the opposite. It remains a bank reserve asset and its value skyrocketed. However, it now has to share the status of bank reserve asset alongside US treasuries. It is not the only money anymore as JP Morgan once said. Now the ability to tax the US population is just as much money as Gold (libertarians cringe in horror here).

Notice that despite the gold delinking, the dual system of money never left the US. You still have private sector money and public sector money. That is why bankers are as powerful as they are. You have private property rights, their money is theirs Ė not the governmentís. Bank deposits (ie private sector money) to this day remain the vast majority of money in the US economy. Countries with successful economies delegate money creation/credit creation decisions to their banks. The USSR centralized credit creation decisions in a central bank and failed miserably over a period of 50 years. Guess what China did? The opposite. They decentralized credit creation decisions to a thousand banks in 1980 after observing the failure of the centralized banking system in the USSR. And as a result the Chinese economy thrived. As much as communists want to get rid of the private sector, thatís a road to ruin. And as much as libertarians want to get rid of the public sector, that is also a road to ruin. The truth is somewhere in the middle, a thriving economy needs both a public and private sector and thus both public and private sector money. Thatís why the FOMC board has consists of bank appointees (Regional Fed Presidents) representing private sector money and government appointees (Governors) representing public sector money.

Fast forward to 2008 Ė the Financial Crisis. The banks turned out to be horrible stewards of private sector money and after the Housing Bubble pops, there is a massive run on the banks. The Fed has to step in and start printing central bank reserves to stem the bank run and literally stuff the private sector bank balance sheets with public sector money in order to restore confidence in the fractional banking system and make sure that all redemptions are paid. In other words, Lincoln money (public sector money) became more powerful and Medici money (private sector money) became less powerful because the bankers screwed up.

The US dollar now has more backing by the US governmentís ability to tax as opposed to the private sector economy. The US dollar is more Lincoln than Medici now. This is a sad result but that is what the private sector gets for making massive mistakes like 2008. Because Medici money is weaker that is why Gold has gone nowhere for many years. For Gold price to go up, you need Medici money to be more powerful than Lincoln money (see 70s). Because there is fewer private sector money to go around, that kills the price of Gold. On the other hand, there is more Lincoln money to go around and that makes Treasuries very expensive (ie yields are low). I know people want interest rates to be higher (or Lincoln money to be cheaper) but thatís not how it works. The US government has to screw up and the private sector has to become dominant for that to happen. Unfortunately, the private sector remains the screw up and the US government remains the entity bailing out the private sector. And for so long as that is the case, Lincoln money will be expensive (ie interest rates will be low) and Medici money will be cheap (Gold price cheap). Notice that the only time when interest rates rose recently was during the Trump administration where his incompetence punctured confidence in Lincoln money (Treasuries) in favor of Medici money (Gold). That is why we saw Gold go up from $1200 to $2000 under Trump and interest rates rise so high in 2018. Now that confidence is back in the US government under Biden, predictably Gold is down and Treasuries are up.

Public Sector Central Bank Digital Currency

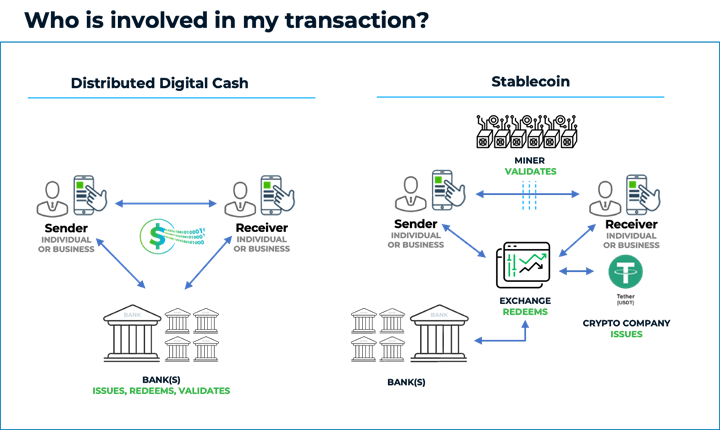

We arrive at the present and the American dual system of money is influencing the debate around CBDC. Should the CBDC be a digital coin issued by the Fed as public money advocates want or should it be digital cash issued by private sector entities like banks or stablecoin issuers like Circle (USDC) and Tether (USDT)? This isnít a simple question to answer. Letís look at the benefits and drawbacks of each scenario.

Quick note here: CBDC wonít replace physical cash or any of the current things that the Fed issues. Instead it will complement them. Cash still will be there. CBDC will be just another technology through which the US dollar gets distributed.

In the first scenario, the Fed issues a CBDC itself directly to the American public. What that means is that there is some kind of a phone app or a web page where every American can open an account directly at the Fed. Americans can go to that app and make transfers back and forth to their bank accounts if they wish or they can just hold their money at the Fed account. And if Americans donít have bank accounts, maybe the Fed might even have to run bank branches for customer support. There is about 8 million unbanked Americans. This design would allow the Fed to target future stimulus in a way that it canít today. Today the Fed has to give stimulus money to banks which make the credit decisions and often times stimulus never reaches the intended recipients simply because they donít have bank accounts or the banks hoard the money for whatever reason. QE has resulted in a lot of wealth inequality over the last 15 years and the reason for that is that the banks are distributing the Fed stimulus, not the Fed itself. At the end of the day, banks are private sector entities and if customers donít churn out profit for them, they donít serve them. There is a discrepancy here. The Fed wants to help everybody in the economy even if they are not productive whereas banks are by statute prohibited from serving clients who produce losses (banks must make profit and make positive return on investment). Many people are unbanked because they are unprofitable for banks to serve. A Fed issued CBDC theoretically can reach these people and thus the Fed can be more successful in stimulating the economy. However, I donít think the Fed wants to be in the business of serving US retail. The Fed then becomes like an Apple or JP Morgan. It has to run servers and a big computer infrastructure that serves the vast American public. It has to secure that infrastructure. It becomes a technology provider. It has to hire top technologists to do that and computer guys are hard to find. It also has to keep up with the latest technology which changes faster than laws can be changed. It also becomes a central point of failure and a magnet for subversive efforts both from foreign states and random anarchists. It is a question if the Fed can do this, whether it wants to do this and whether this falls within the parameters of its mandate to provide full employment and stable prices.

The answer is that is not the Fedís job. The Fedís job is to provide monetary stimulus not provide banking services to the unbanked population of the US. What I think will happen here is the US will create a new Public Bank whose job will be to serve the unbanked population in the US. A public bank can carry unprofitable customers. The Post Office branches can double as Public Bank branches. The Fed then can issue CBDC to that US Public Bank and let the bank deal with the American public. Every American can open an account there in addition to their existing private sector bank accounts. If people want to get stimulus directly from the Fed, they have to open those public bank accounts. I imagine such a scenario will be opposed by the existing banks like JPM and Bank of America because it is direct competition. However, if there is a public bank, the Fed wonít have to require banks to adhere to the Fed rate for savings accounts. So to attract capital banks can start offering higher interest rates on savings. A US Public Bank will have 2 mandates Ė distribute targeted Fed stimulus and serve the unbanked. This retains private sector banking (JPM, Bank of America, etc) as the main credit decision maker in the economy. So I think having a public bank is actually going to be a much better outcome for the private sector banking industry. BTW, Germany has a set of public banks today so having something like this is not unprecedented in the Western world. Bank of Canada and Commonwealth Bank in Australia were also public (government) banks in the past.

There is another potential solution that some will consider where the existing private sector banks will take on the job of managing CBDC accounts on behalf of the Fed and assist the Fed in providing both stimulus and services for the unbanked population. Presumably banks already have the expertise to serve retail. That they do, but again will banks want to serve people that donít make profit for them? I doubt it. We are also looking at multiple implementations of the same functionality in different organizations and as we saw with the PPT loans that was not an ideal solution at all. Stimulus reached different groups at different times, some organization struggled to find the additional resources to implement the new federal requirements and there were questions about corruption and so forth. A bank implementation of CBDC would face the same concerns. So I think the private sector bank solution will be looked at and ultimately discarded in favor of a public bank solution.

Private Sector US Dollar Stablecoins

Now we get to the second scenario Ė privately issued stablecoins. We already have Circleís USDC and Tetherís USDT. Private sector entities can keep up with the latest trends and innovate. They can support as many blockchains as underlying technology as they wish. Currently Circle intends to offer USDC over something like 10 chains in addition to the current ones Ė Ethereum, Algorand and Solana. There is also more privacy in using a private sector entity where the government canít overreach and censor individuals directly or at minimum government overreach can be checked by the private sector. As much as people think the US government and private sector are one and the same, they arenít. Private sector censored Trump while he was President - something the US government never would have happened while Trump was the executive (or even if he wasnít the executive). So there are privacy and distributed censorship benefits to privately issued stablecoins over a Fed coin (CBDC).

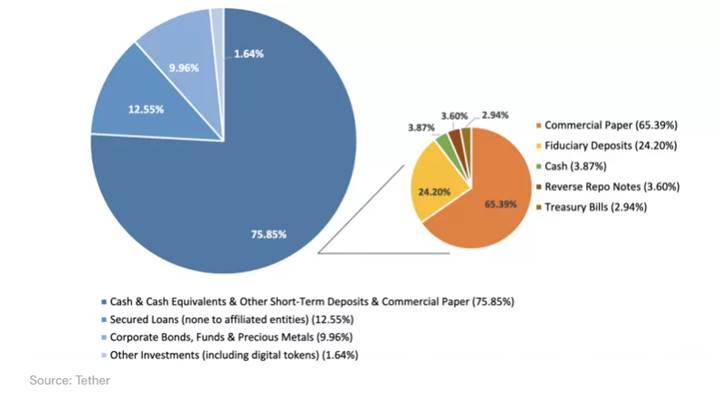

The Fed can serve as a backstop to private sector stablecoin issuers and should require that stablecoin issuers register with it. A stablecoin issuer shoudnít be all that different from a bank from a regulatory standpoint. One area which the Fed has to regulate is what assets can back the stablecoins that are issued. Tether and Circle need to be regulated by the Fed and they need to have transparency about their asset holdings. For example Circle hasnít revealed its assets even though it is assumed that its USDC is overcollaterized. But nobody knows by how much. There is no such public report made available yet. USDT (Tether) issued a report about its asset holdings and it turns out most of it is backed by commercial paper. USDT is not as overcollaterized as some thought. Only 0.37% (or leverage ratio of 289 to 1). For example, Fannie Mae and Freddie Mac had overcollaterization of 1.5% (leverage ratio of 60 to 1) and became insolvent with that during the Financial Crisis in 2008. So Tether is not as secure as some may think. Tether is similar to a money market fund but a bit more risky. Yet that is not exactly the same as a Fed issued US dollar particularly if the market is under stress like it was in 2008 where a number of money market funds ďbroke the buckĒ. So these are definitely issues that the Fed needs to regulate for private stablecoin issuers. At the end of the day, the US dollar is liability of the US government and other entities canít simply conjure up US dollars out of thin air. The Fed needs to be intimately involved in US dollar creation wherever in the world it happens and whichever way it happens. For US Dollar stablecoins to have credibility especially among the retail public, strong regulation by the Fed is exactly what is needed here. Not in terms of how stablecoin issuers technically implement the stablecoin, but what mix of assets is acceptable to be backing a USD stablecoin.

The benefits of the private sector stablecoin solution is decentralization (many issuers) and reduction of single point of failure risk, the ability to experiment with different asset backing strategies (financial innovation), outsourcing of technological upgrades (technology, blockchain innovation) and consumer privacy (stablecoins are more like cash as opposed bank accounts that carry identity). The drawbacks are that Fed wonít be able to target stimulus or guarantee that the unbanked population will be served.

Here is one big benefit of US dollar stablecoins that I hear rarely discussed: they can dramatically expand the reach of the US dollar abroad. People abroad can only use their local banks and therefore only hold money in their local currency. However with USDC, anybody anywhere can create a USDC wallet on any computing device. They can do it on exchanges or on self-custody mobile apps or computer programs. Now people in a country like Venezuela can have US dollar deposits. As you can imagine only the rich in Venezuela have dollar bank accounts. The rest are unbanked because they are not profitable customers for the local banks. A US dollar stablecoin can change all of that. At the end of the day people abroad donít want the volatile Bitcoin as a day to day medium of exchange. They want the stability and liquidity of the US dollar if it was only accessible. USDC and USDT make the US dollar more accessible to world-wide audience at all income levels more than ever before.

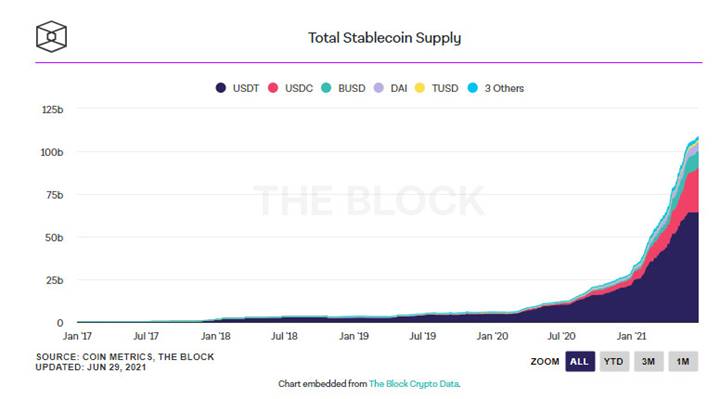

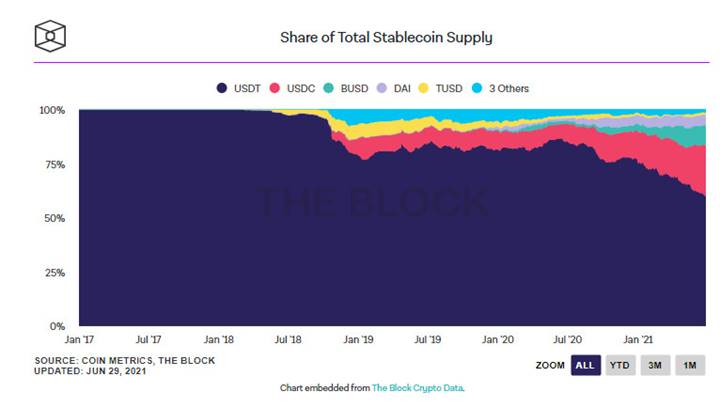

BTW, this low cost accessibility of CBDC is why China is pushing ahead quickly with its Digital Yuan project. They want to target the unbanked population of Africa, Latin America and the Muslim countries in the Middle East. They want to capture that market first. If you are an unbanked person in Africa and you are given an app where you can store Chinese Yuan which is basically pegged to the US dollar, you will do for it in a heartbeat. That person wonít care about all the other macro considerations that makes professional investors pick a US dollar over the Chinese Yuan. All unbanked care about is stable money on their phone. Digital Yuan is stable enough. But then through this side door, the Chinese Yuan becomes a global reserve currency. If the US wants to combat the Digital Yuan effectively it needs to articulate and push a digital US dollar strategy as soon as possible. There canít be any delays here. This is a space race of the 2020s - the digital currency race. And the US actually has the heads up. USD stable coins are more than $100 billion asset class now. The Fed needs to get to work and give them US government legitimacy and from there they will spread like weed abroad through the private sector. The US government also needs to make sure it funds a private sector effort targeting the unbanked in Africa, Latin America and the Middle East.

Ultimately what I think happens here is that the US government will do the following:

1. Regulate private sector US dollar stablecoins and pass laws to legitimize them and set rules of the road. This potentially could be an issue for USDT and BUSD Ė USD stablecoins issued by foreign entities. This could be a boon for Circleís USDC.

2. Establish US Public Bank to distribute Fed stimulus and serve unbanked US population

3. The US government will choose one official private stablecoin like Circleís USDC to be used for US Public Bank accounts. Then when the Fed prints digital dollars for economic stimulus, it will be creating USDC and transferring them to the US Public Bank to target to individual accounts.

4. Allow banks to issue stablecoins (in addition to standalone stablecoin issuers). In that respect, Circle may be purchased by a bank like JP Morgan in the future.

5. Provide funding for international adoption of US dollar stablecoins in unbanked populations in Africa, Latin America and Middle East

At the end of this, the US dollar will be bigger than it has ever been and its reach in the global economy bigger than ever. Potentially this expansion of US dollar use globally could be on the scale of that accomplished after World War 2. A company like Circle could become enormous in its global reach. In its attempt to take out the US dollar, the only thing Bitcoin will accomplish is make it bigger. The President of El Salvador is pushing Bitcoin wallets on smartphones as a way to serve the unbanked population of his country. Within 6 months what will actually happen with El Salvadorís unbanked population is they will be using and transacting with USDC on their phones.

The Fed currently has an initiative called FedNow underway that is researching the digital currency space and is implementing some form of a solution. This project is supposed to be out in 2 years. I think it needs to move faster. The Fedís Fedwire Funds Service processes $4 trillion in payments every day. The private-sector ACH (Automated Clearing House) settles $2 trillion in payments every day. That gives you an idea how big the USD stablecoin market can get. It is currently $100 billion. Getting to $6 trillion is a 60x from here. There will be massive amounts of innovation happening over the next 2 years with the Digital Dollar.

VIXCONTANGO ē VIX Investment Advice & Analysis ē Profit from Volatility

Copyright 2015-2021 © Black Peak Ventures. All rights reserved.

Black Peak Ventures does not provide professional financial investment advice specific to your life situation. Black Peak Ventures provides investment analysis of the CBOE VIX futures market and related exchange traded products using algorithmic and discretionary signals derived from proprietary indicators, measurements and analytics. The use of trading algorithms and judgments about the attractiveness, value and potential appreciation of particular volatility ETPs and their options may prove to be incorrect and may not produce the desired results. Volatility ETPs may have significantly greater daily movements than those of the broad US equity markets.

This e-mail, including any attachments, is intended for use by you and is not for public distribution. This e-mail contains information that is, or may be confidential or proprietary in nature. Unless specifically stated in the message or otherwise indicated, you may not duplicate, redistribute or forward this message or any portion thereof, including any attachments, by any means to any other person. If you are not the intended recipient, please be advised that you are legally prohibited from retaining, using, copying, distributing, or otherwise disclosing this information in any manner. Attachments that are part of an electronic communication may have additional important disclosures and disclaimers, which you should read. Furthermore, this communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product, or as an official statement of Black Peak Ventures or any of its affiliates. Nothing in this document constitutes investment, legal, accounting or tax advice or a representation that any investment strategy or service is suitable or appropriate to your individual circumstances. This document is not to be relied upon in substitution for the exercise of independent judgment. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. The information provided herein is expressed as of the date hereof or such other date specified. Black Peak Ventures and its affiliates assume no obligation to update or otherwise revise these materials.